WorldCover, a New York and Africa-based meridian word provider to smallholder farmers, has lifted a $6 million Series A turn led by MSAD Ventures.

Y Combinator, Western Technology Investment and EchoVC also participated in a round.

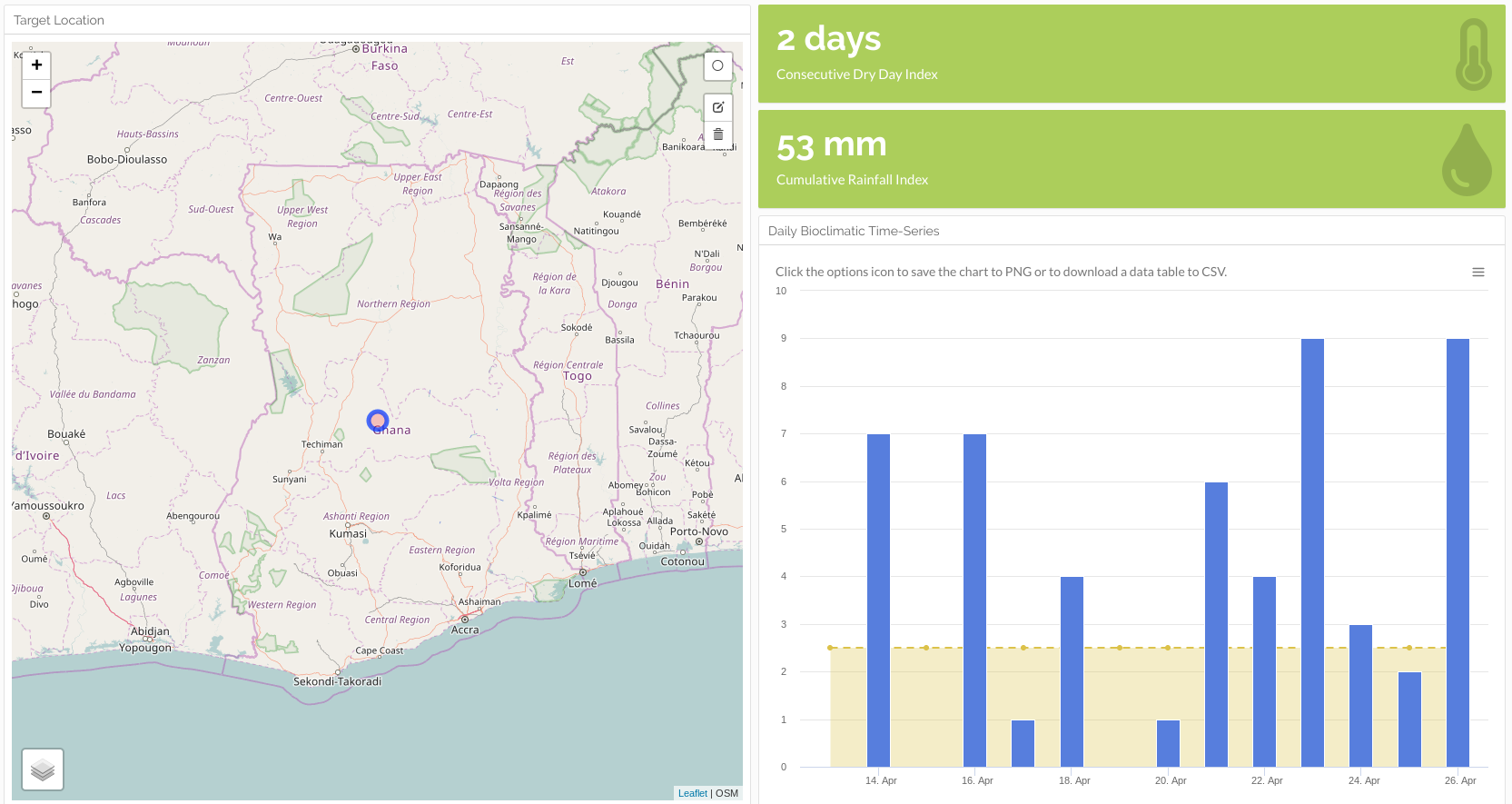

WorldCover’s height uses satellite imagery, on-ground sensors, mobile phones and information analytics to emanate word options for farmers whose stand yields are influenced adversely by continue events — essentially miss of rain.

The startup now operates in Ghana, Uganda and Kenya . With a new funding, WorldCover aims to enhance a word offerings to some-more rising marketplace countries.

“We’re looking during India, Mexico, Brazil, Indonesia. India could be initial on an 18-month timeline for a launch,” WorldCover co-founder and arch executive Chris Sheehan pronounced in an interview.

The association has served some-more than 30,000 farmers opposite a Africa operations. Smallholder farmers are those earning all or scarcely all of their income from agriculture, tillage on 10-20 acres of land and earning around $500 to $5,000, according to Sheehan.

Farmers bond to WorldCover by formulating an comment on a USSD mobile app. From there they can submit their segment and stand form and establish how most word they would like to buy and use mobile income to squeeze a plan. WorldCover works with payments providers such as M-Pesa in Kenya and MTN Mobile Money in Ghana.

The use works on a shifting scale, where a patron can accept anywhere from 5x to 15x a volume of reward they have paid. If there is an inauspicious continue event, namely miss of rain, a rancher can record a explain around mobile phone. WorldCover afterwards uses a data-analytics metrics to consider it, and, if approved, a rancher will accept an word remuneration around mobile money.

Common crops farmed by WorldCover clients embody maize, rice and peanuts. It looks to supplement coffee, cocoa and cashews to a coverage list.

For a moment, WorldCover usually insures for events such as rainfall risk, yet in a destiny it will demeanour to embody other continue events, such as pleasant storms, in a word programs and height information analytics.

For a moment, WorldCover usually insures for events such as rainfall risk, yet in a destiny it will demeanour to embody other continue events, such as pleasant storms, in a word programs and height information analytics.

The startup’s owner simplified that WorldCover’s indication does not consider or produce word payouts privately for meridian change, yet it does directly bond to a company’s business.

“We word for inauspicious continue events that we trust meridian change factors are exacerbating,” Sheehan explained. WorldCover also resells a risk of a policyholders to tellurian reinsurers, such as Swiss Re and Nephila.

On a intensity marketplace distance for WorldCover’s business, he highlights a 2018 Lloyd’s investigate that identified $163 billion of resources during risk, including agriculture, in rising markets from negative, meridian change-related events.

“That’s what WorldCover wants to go after…These are a kind of micro-systemic risks we consider we can indication and afterwards emanate a micro product for a smallholder rancher that they can know and will give them protection,” he said.

With a round, a startup will demeanour to possibilities to refurbish a height to offer tillage recommendation to smallholder farmers, in further to word coverage.

WorldCover financier and EchoVC owner Eghosa Omoigui believes a startup’s word offerings can indeed assistance farmers urge yield. “Weather-risk drives a lot of decisions with these farmers on what to plant, when to plant, and how most to plant,” he said. “With a stand word option, a rancher says, ‘Instead of one hector, we can now plant dual or three, since I’m covered.’ ”

Insurance record is another zone in Africa’s tech landscape stuffing adult with venture-backed startups. Other word startups focusing on cultivation embody Accion Venture Lab-backed Pula and South Africa formed Mobbisurance.

With a new turn and skeleton for tellurian expansion, WorldCover joins a flourishing list of startups that have grown business models in Africa before lifting rounds toward entering new markets abroad.

In 2018, Nigerian remuneration startup Paga announced skeleton to pierce into Asia and Latin America after lifting $10 million. In 2019, South African tech-transit startup FlexClub partnered with Uber Mexico after a seed raise. And Lagos-based fintech startup TeamAPT announced in Q1 it was looking to enhance globally after a $5 million Series A round.